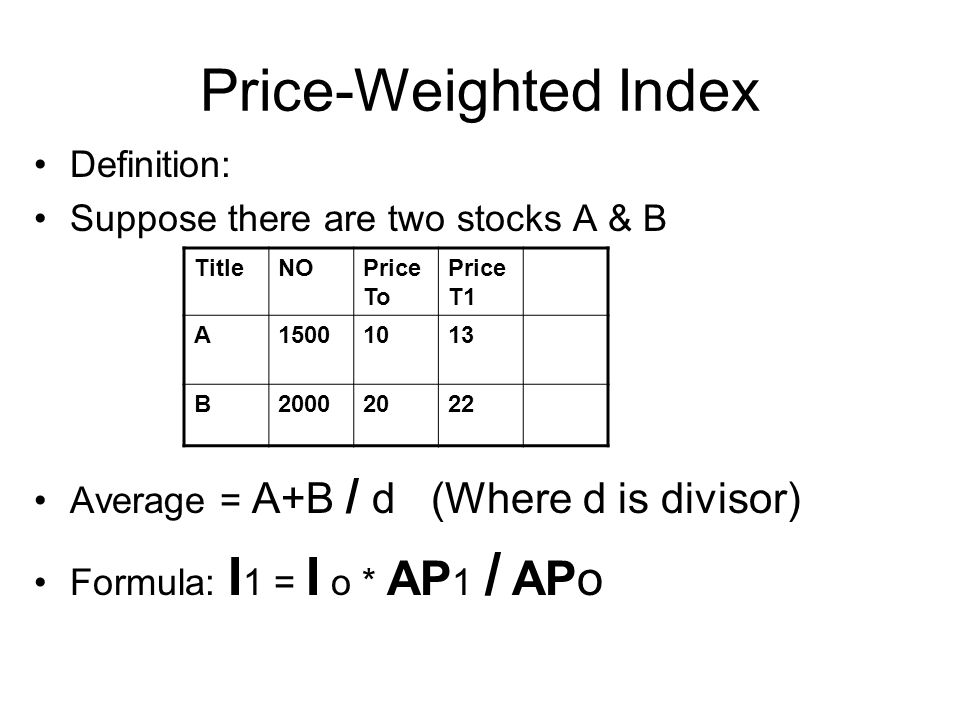

Price weighted index formula

Market Capitalization Stock Price x No. Company A 5 x 5000000 25000000.

:max_bytes(150000):strip_icc()/dotdash_Final_Equal_Weight_Apr_2020-01-6b2bdb8ccaf74b8d9170fafe5851d5df.jpg)

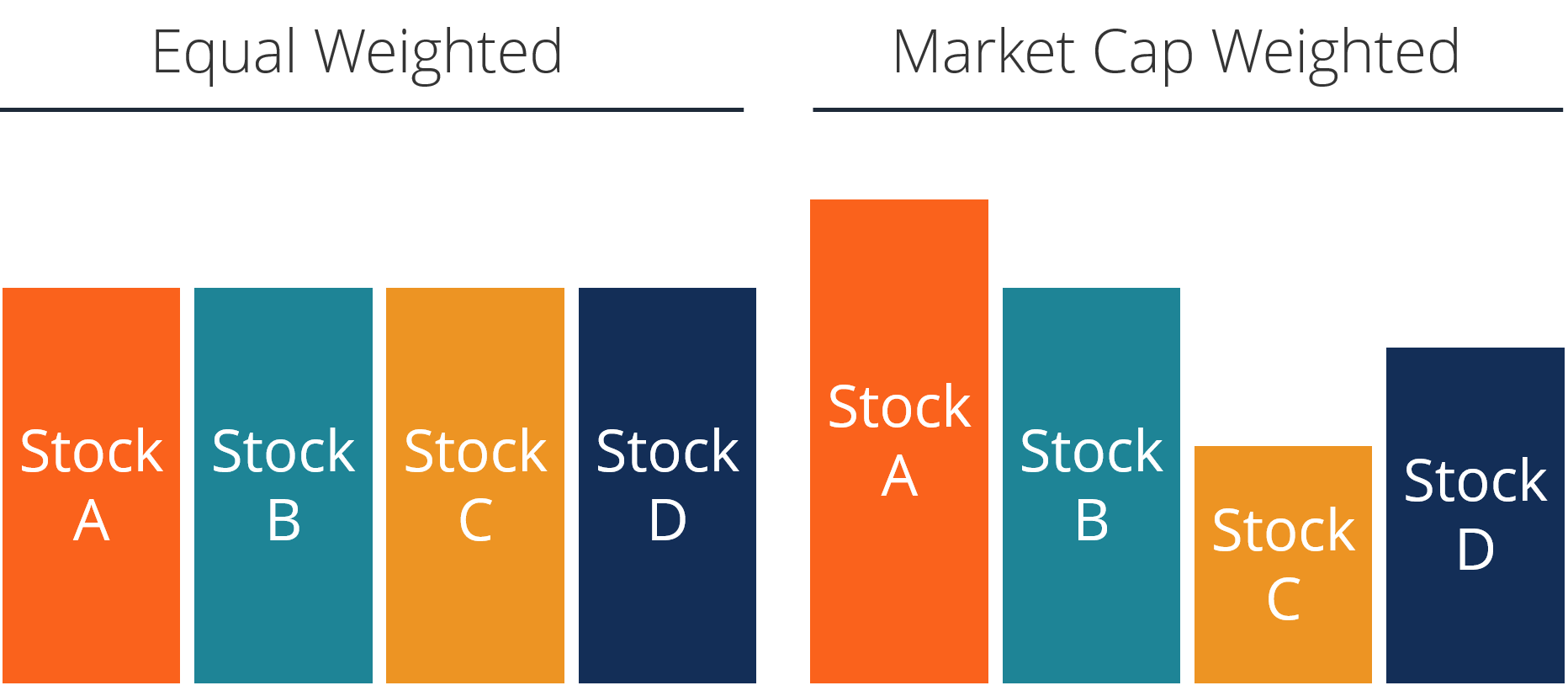

Equal Weight Definition

Therefore the price indexes were as follows for each year.

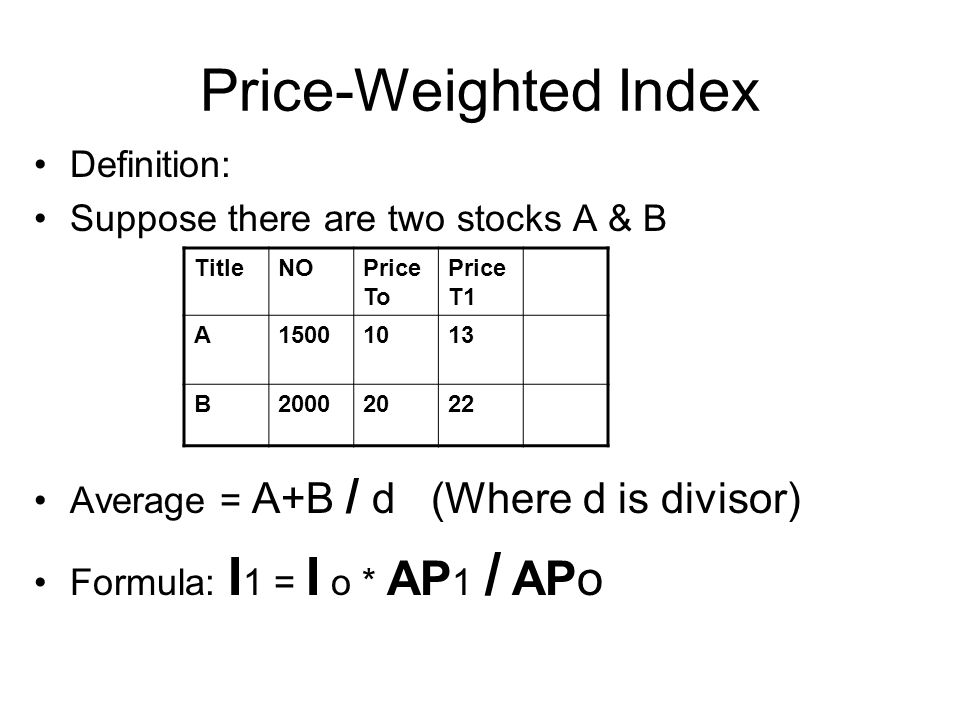

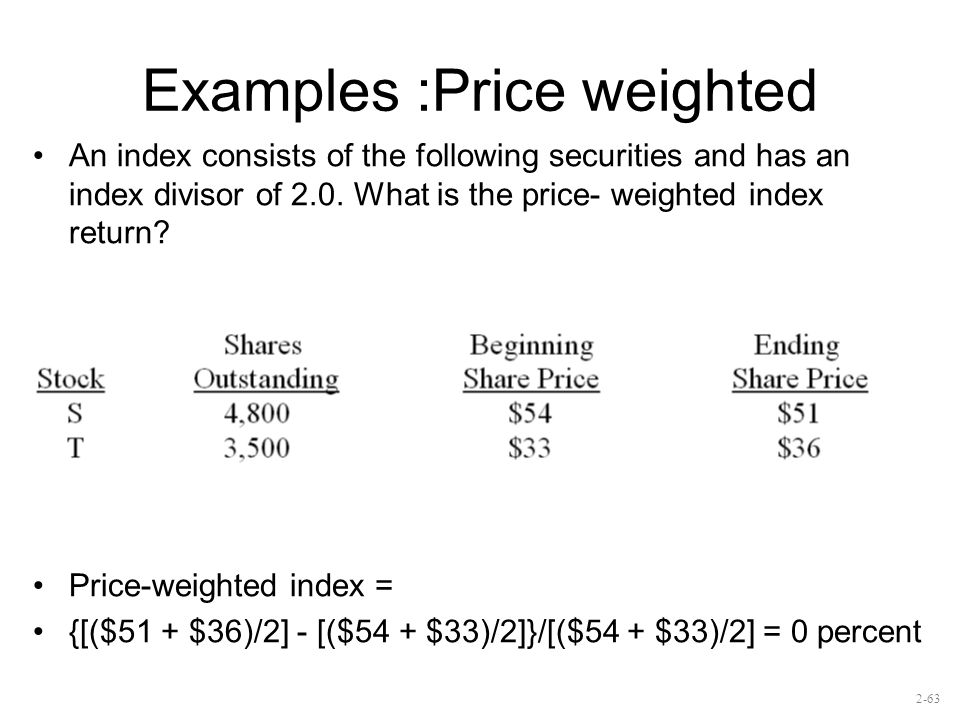

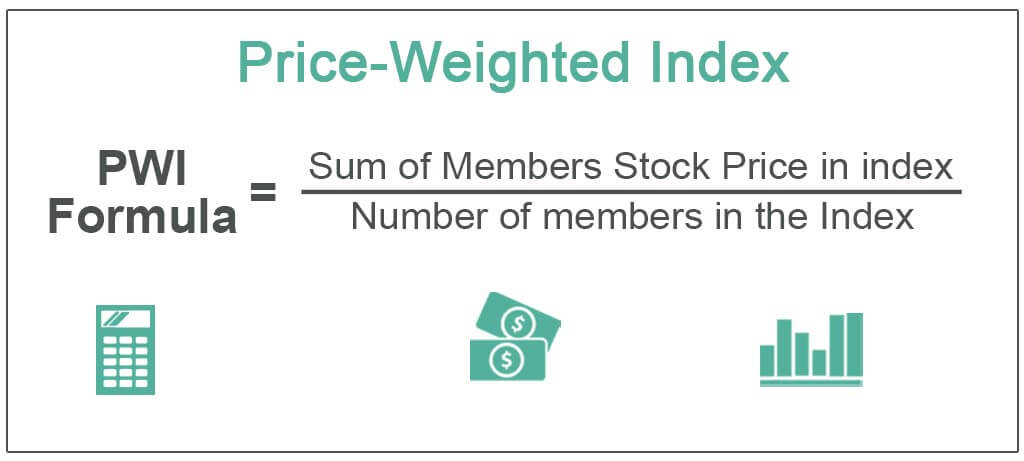

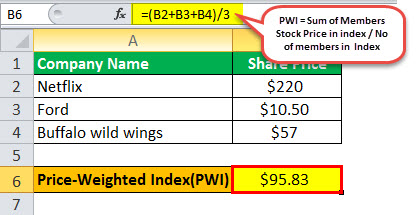

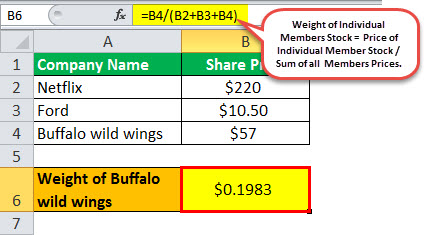

. Add the stock price of each company in the index at the start of the period. Calculation The weight of each stock in a price-weighted index can be calculated by dividing its stock price per share by the sum of share prices of all the stocks in the index. Wi fraction of the portfolio that is allocated to the security or.

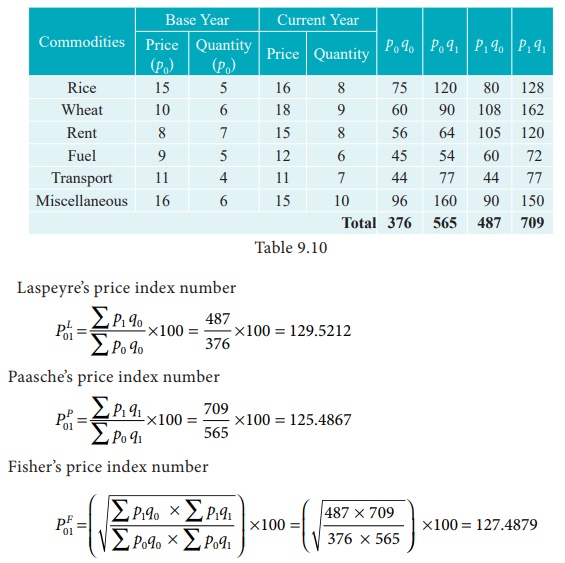

A price index aggregates various combinations of base period prices later period prices base period quantities and later period quantities. A number used in the denominator of the ratio between the total value of an index and the index divisor. Price index numbers are usually.

V P RI N i1niP i D V P R I i 1 N n i P i D Where. The formula for calculating the value of a price return index is as follow. The formula for the index is as follows.

WP i P i N i1P i w i P P i i 1 N P i Where. VPRI the value of the price return index ni. With a price-weighted index the index trading price is based on the trading prices of the individual stocks that make up the index basket.

Weighted Aggregate Method. In weighted aggregation weights are assigned to various itemsInstead of obtaining the simple aggregate of price the weighted aggregate of. In Laspeyres price index number the quantity of the base year is used as weight.

The number which typically has little mathematical. Using the formula for the Laspeyres Price Index. To get exact Fishers price index number one should use formula method rather than using.

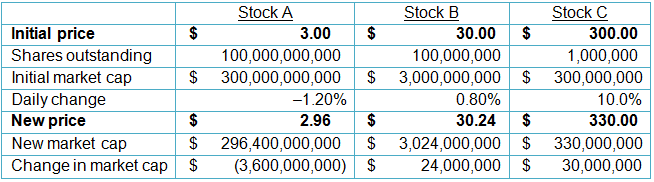

Of Shares Outstanding Thus the market capitalization of each company in the index is. Pi0 is the price of the individual item at the base period and Pit is the price of the individual item at the observation period. Stocks with higher prices are given.

Year 1 12823. The index corrects for the upward bias of the Laspeyres Price Index and the downward bias of the Paasche Price Index by taking the geometric average of the two. For example if you want to figure the rate of return for a given year add the opening stock prices of each.

Year 0 Base Year 100. The value-weighted index formula is I dfrac current market cap base market cap times base value In practice this formula becomes more complicated. Price Weighting Here the weight of each security i is given by.

Index Calculation Primer Roger J Bos Cfa Senior Index Analyst Standard Poor S Ppt Download

How To Calculate Price Weighted Stock Market Index

Introduction To Fundamentally Weighted Index Investing

Price Weighted Index Formula Examples How To Calculate

Simple Index And Weight Index Examples In R

Price Weighted Index Formula Examples How To Calculate

Price Weighted Index Return Youtube

Weighted Aggregate Price Index Mba Lectures

Stock Market Index Ppt Video Online Download

Introduction To Fundamentally Weighted Index Investing

Price Weighted Index Formula Examples How To Calculate

Equal Weighted Index Definition Advantages And Disadvantages

Equally Weighted Index Financial Edge

Solved Price Weighted Index Constructed With The Three Stocks 2 What Is The Value Weighted Index Constructed With The Three Stocks Using A Divis Course Hero

Weighted Index Number Definition Solved Example Problems Applied Statistics

How To Calculate Value Weighted Index

Does It Matter How An Index Is Put Together